Mortgage calculator deposit much can borrow

Your options if youre struggling to save. This provides a ballpark estimate of the required minimum income to afford a home.

5 Ways To Get A High Lvr Home Loan Credit Repair The Borrowers Loan

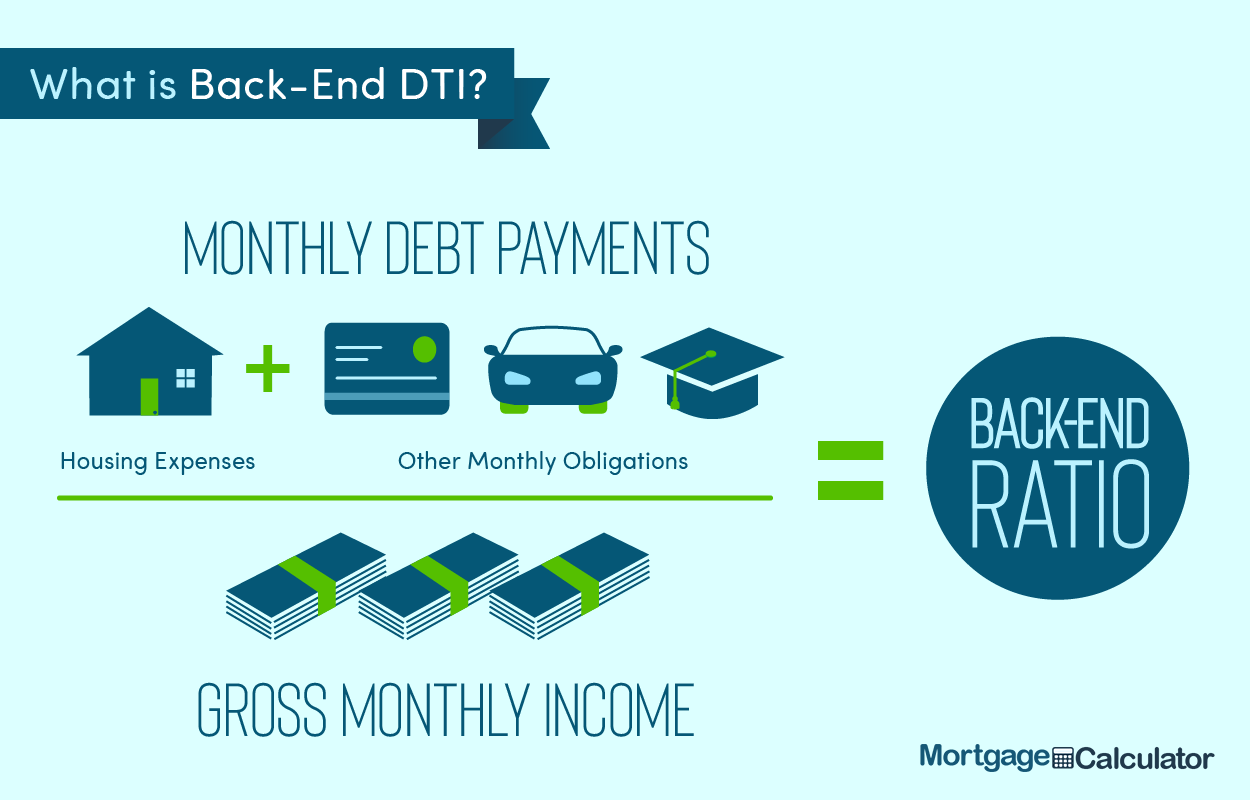

Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan.

. Find out how much you could borrow for a mortgage. MBL any Macquarie entity referred to on this page is not an authorised deposit-taking institution for the purposes of the Banking Act 1959 Cth. Interest rates are also a consideration and in most cases mortgage lenders will ensure you will still be able to repay the amount you borrow if interest rates were to increase.

If you miss your mortgage payments your guarantor has to cover them. You can also calculate your monthly repayments and interest rate. This is usually one percent higher than a mortgage that requires a deposit.

The bigger your deposit the smaller your loan will be and the less interest youll have to pay. However as a drawback expect it to come with a much higher interest rate. Our How Much Can I Borrow.

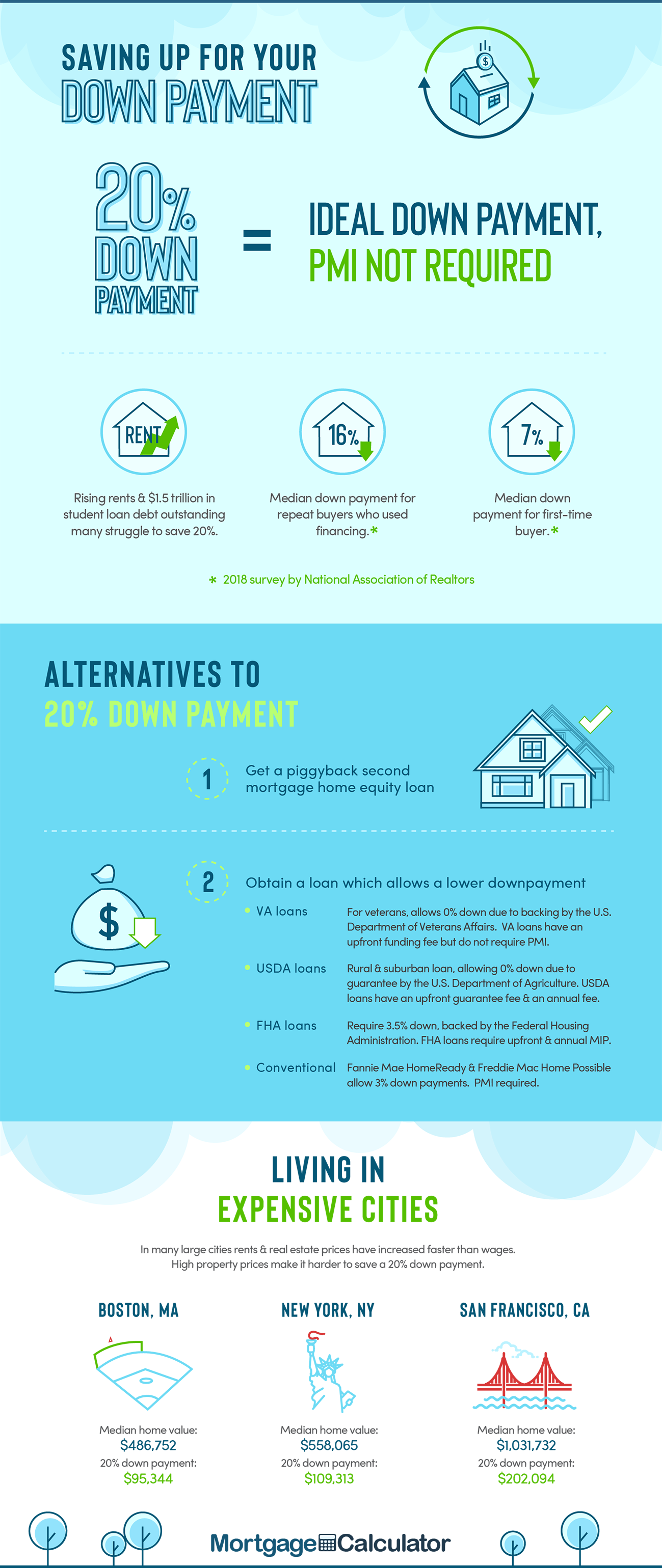

While every mortgage lender has their own criteria for determining how much you can borrow they all look at the following key factors when calculating a buy to let mortgage. If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit. This will be dependant on your financial situation property value and the size of your deposit or.

Use our offset calculator to see how your savings could reduce your mortgage term or monthly payments. Before applying for a mortgage you can use our calculator above. Calculator can give you an estimate of the loan amount.

Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts. This mortgage calculator will show how much you can afford. If you cant save enough some mortgages let you apply with a guarantor instead of a deposit.

How much can I borrow. You put down a deposit of 5 the government lends you up to 20 in England and Wales or 40 in London and you get a mortgage to cover the remainder. It takes about five to ten minutes.

Government scheme offering discounts of up to 30 for. 2000 cashback when you refinance to us If youre eligible and you apply to move your home loan to us by 28 February 2023 you could get less home load with 2000 cashback. Certificates of Deposit CD.

You can calculate your mortgage qualification based on income purchase price or total monthly payment. Affordability calculator get a more accurate estimate of how much you could borrow from us. Offset calculator see how much you could save.

Our home loan calculator helps you estimate what your mortgage repayments could be. That entitys obligations do not represent deposits or. Factors that impact affordability.

Consider this expensive trade-off before choosing a zero-deposit deal. Mortgage calculator Mortgage repayment calculator Stamp duty calculator Mortgage deposit. The size of your deposit will make a massive difference to the mortgage deal you can find.

Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be. The minimum required deposit is 10 but aim for 20 if possible. Buy-to-let calculator see if we could lend you the amount you need for a property youll rent out.

However obtaining this sort of deal usually forces a borrower to pay a much higher interest rate on their loan. Certificates of deposit CDs Mutual funds stocks and bonds. A 95 mortgage also known as a 95 loan-to-value LTV mortgage is a mortgage to purchase a property with a small deposit at least 5 but less than 10 deposit of the purchase price.

See how much you can borrow with our. This provides a rough estimate of how much you can borrow for a loan. Find out how much you could borrow with our calculator.

Ideally you should save as much as possible before buying a home. Your deposit is the amount of money that you need to put into the mortgage to make up 100 of the final purchase price. This mortgage finances the entire propertys cost which makes an appealing option.

Loan to Value LTV This is the amount of the mortgage expressed as a percentage of the property value. Saving a bigger deposit. Help to Buy equity loan.

While your personal savings goals or spending habits can impact your. Shows how long youd need to save for a deposit depending on the price of the property and percentage of its value you need to put down. Its a good indicator of whether you satisfy minimum requirements to qualify for a mortgage.

If the property is valued at 650000 and you have a 20 deposit of 130000 then the principal loan amount is 520000. When it comes to calculating affordability your income debts and down payment are primary factors. How much can I borrow.

Mortgage borrowing calculator Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. The mortgage qualifier calculator steps you through the process of finding out how much you can borrow. Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate.

Meanwhile some lenders may offer first-time buyers a 100 mortgage with a 0 deposit. Use our mortgage deposit calculator to see when youll have saved enough money for a property deposit in your area. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment.

A bigger deposit gives you more options and lower rates. If you want a more accurate quote use our affordability calculator. Plus the bigger your deposit the smaller your loan.

Help is at hand if youre struggling to save up a big enough deposit for your first home. Use our mortgage calculator to see how much you may be able to borrow with a NatWest mortgage our mortgage rates and what your monthly mortgage payments could be in under 5 minutes. You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit.

Our mortgage calculators can give you a rough idea of how much you could borrow for your mortgage by taking the above factors into consideration. Our calculator allows you to choose repayment frequency loan term extra repayments and more. The bigger your deposit the more likely you are to get a better mortgage deal so start planning now.

Need To Borrow Funds Know Which Loans Best Suits Your Needs Financial Aid For College World Finance Business Loans

Emi Calculator Easy To Know Your Monthly Loan Payment Personal Loans Loan Calculator Paying Off Mortgage Faster

A Home Of Your Own Living Room Theaters Home Buying Living Room Bench

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Loan Repayment Calculator Personal Loans Mortgages Repayments Disabled World

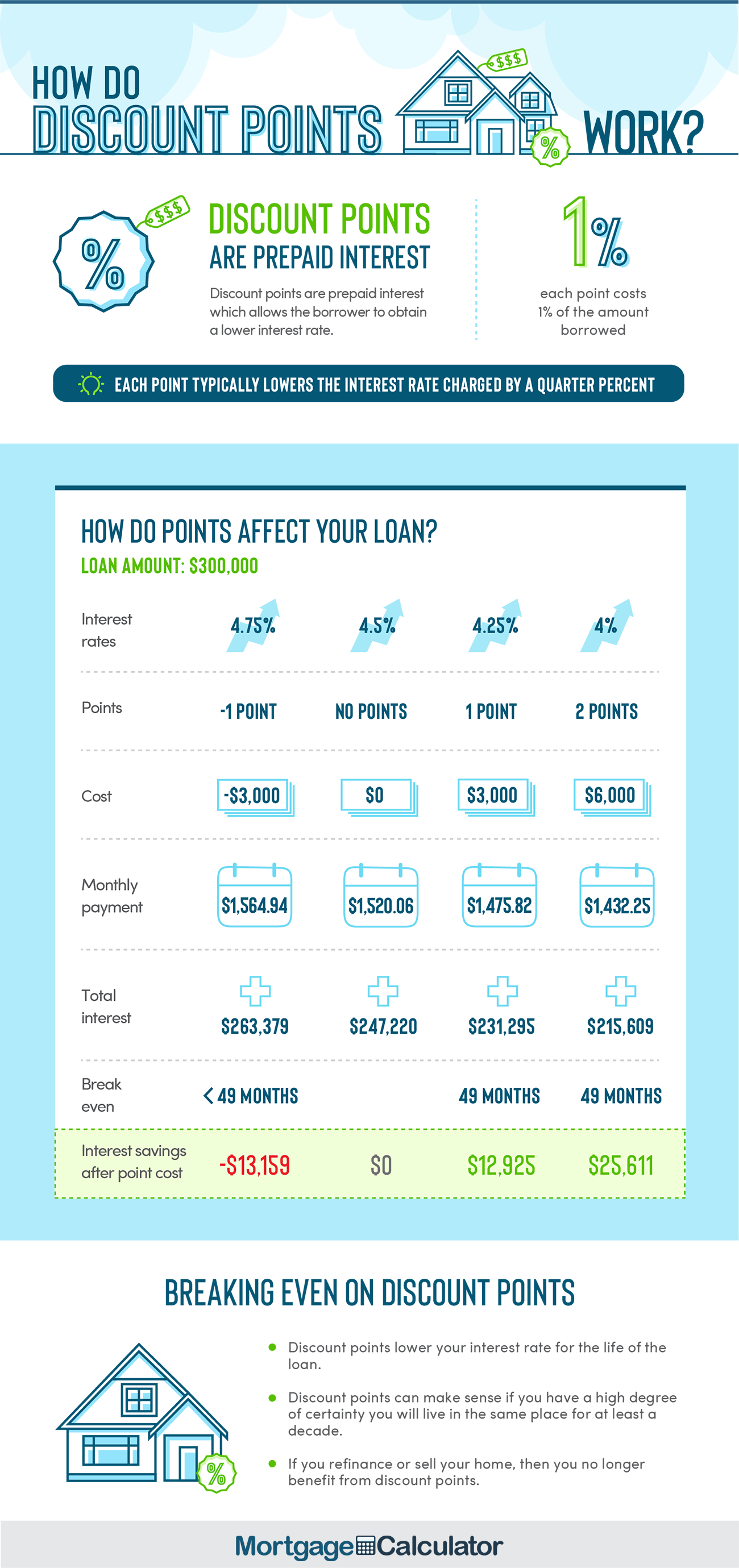

Discount Points Calculator How To Calculate Mortgage Points

Tips On Home Warranty Coverage For Home Owners Home Security Tips Home Security Home Warranty

Mortgage Calculator How Much Monthly Payments Will Cost

How Much A 350 000 Mortgage Will Cost You Credible

5 Signs Real Estate Agents Can Stretch The Truth Real Estate Agent Real Estate Real Estate Career

Mortgage Calculator Money

Savings For A Downpayment On A Home Mortgage Down Payment Savings Goal Calculator

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Mortgage Calculator How Much Monthly Payments Will Cost

What S My Monthly Mortgage Payment First Financial Bank

Slash Interest Rates With These 4 Easy Tips Refinance Loans Interest Rates Loan Rates